Financial Information at 30 September 2018

08 November 2018

Operating result and net profit improve. Life net cash inflows rebound. Capital position remains solid even with highly volatile markets.1

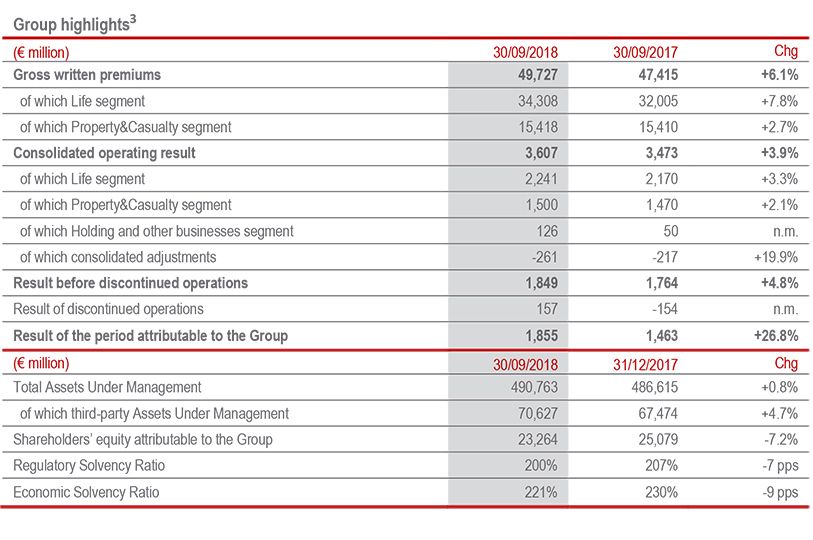

- Operating result increased to € 3.6 billion, up 3.9% as a result of improvements in all business segments

- Combined ratio confirmed at excellent levels (92.8%), even considering the significant impact of natural catastrophes and man-made claims. Life new business margin continued to grow reaching 4.48%

- Premiums increased by 6.1% to nearly € 50 billion thanks to the growth in both business segments, with an acceleration in Property & Casualty (+2.7%). Life net cash inflows rebounded to € 8.6 billion (+3.3%)

- Average operating RoE for the period 2015-9M2018 at 13.4% in line with the strategic target (>13%); annualised operating RoE2 at 12.7%

- Net profit increased to € 1,855 million (+26.8%), also thanks to the positive non-operating performance and the result from disposals. Result before discontinued operations up 4.8%

- Solid capital position, with Regulatory Solvency Ratio at 200% and Economic Solvency Ratio at 221%, even with volatility in financial markets

Generali Group CFO Cristiano Borean stated: “The improvement posted in the first half of the year continued, with strong results in terms of the technical performance both in Property & Casualty - confirmed by the excellent combined ratio - and in Life with net cash inflows rebounding and new business margin improving compared to the first 9 months of last year. Investments, Asset & Wealth Management activities grew, also thanks to the multi-boutique strategy that we are implementing with discipline, in line with our pre-announced targets. The capital position remained solid, a significant achievement even the volatility in the financial markets during the year; this is proof of our ability to effectively manage uncertainty. With these strong results, we are ready to present the new three-year strategic plan, focused on continued growth, transformation, and the creation of sustainable value for all of our stakeholders.”

Munich. At a meeting chaired by Gabriele Galateri di Genola, the Board of Directors of Assicurazioni Generali approved the Financial Information at 30 September 2018.

Premiums and New Business

- The Group's total premiums amounted to € 49,727 million (+6.1%), confirming the growth previously posted in the first six months of the year as a result of positive trends in both business segments.

The Life segment posted an increase of 7.8% deriving from growth in all business lines, in particular the protection line, in almost all countries in which the Group operates. During the first half of the year in Italy, there was a renewal of collective policies that amounted to nearly € 1.2 billion, resulting from actions on the existing savings portfolio: even excluding this amount, the Group's total Life premiums posted an increase (+4.1%). After strong acceleration in the second quarter, the Group's net cash inflows stood at € 8.6 billion, posting an additional increase in the third quarter, leading to total growth of 3.3%, which was concentrated, in particular, in France and Asia.

Property & Casualty premiums grew by 2.7% boosted by the positive performance of both business lines. The Motor line increased by 2.9% due to growth in ACEER4 (+5.6%), France (+3.3%), and the Americas and Southern Europe (+19%). Italy declined by 2.2%, although the third quarter of the year showed a recovery. The Non-Motor line also increased (+2.4%), thanks to the trends observed in almost all countries in which the Group operates. Growth was posted in ACEER (+3.2%), mainly in the home business, France (+2.3%) due to pricing policies, Germany (+1.5%) for growth posted in the Global Corporate & Commercial lines, as well as Europ Assistance (+12.8%), particularly in mature markets, due to growth in travel insurance and roadside assistance. Italy posted a decrease of 1.6% resulting from the performance of the Global Corporate & Commercial lines following the focus on profitability; the third quarter of the year was positive as a result of a recovery in the accident and health lines. -

New business in terms of PVNBP (present value of new business premiums) amounted to € 30,587 million, down 1.8% compared to the first nine months of 2017. Broken down by business line, there was a marked decline in savings and pension products (-4.2%), due to the contraction in Italy, Germany and Spain, as well as a slight drop in protection products (-0.7%) due to a decline in Germany and France. This result was partially offset by the increase in premiums for unit-linked products (+1%), primarily in Italy and France.

The new business value (NBV) was € 1,370 million, increasing by 3.2% (€ 1,341 million at 9M17). The margin on PVNBP stood at 4.48% (4.17% at 9M17) with an increase of 0.22 pps due to the improved business mix, reduction of financial guarantees, and improvement of financial assumptions compared to the first nine months of 2017.

Economic Performance

- The operating result stood at € 3,607 million, up 3.9% as a result of improvements in all business segments.

The operating result of the Life segment was positive (+3.3%), mainly reflecting the improvement in the technical margin net of insurance operating expenses, due to the acceleration in the third quarter.

The Property & Casualty operating performance also posted improvement (+2.1%): the contribution from the technical result was positive due to the decline of 0.3 pps in the combined ratio, which remained at excellent levels (92.8%), following the improvement in the current year loss ratio excluding natural catastrophes. The contribution from prior years was essentially stable. During the period, catastrophic claims amounted to nearly € 215 million, for a total of 1.5 pps, which mainly affected Italy, France and Germany (similar events had an impact of 1.8 pps during 9M17).

In addition, during the first nine months there was a higher impact - amounting to nearly € 90 million - of man-made claims, mainly concentrated in the third quarter in the Global Corporate & Commercial lines.

Lastly, the operating result of the Holding and other businesses segment was positive, due in particular to the favourable development of Investments, Asset & Wealth Management activities. There was a slight increase in Holding expenses following new development activities. - The Group net profit stood at € 1,855 million, up 26.8%. In addition to the improvement in the operating result mentioned above, it mainly reflected:

- improvement in the non-operating result. Despite the decrease in investment result due to the planned lower realised gains, especially for bonds, and the higher impairments on equities due to the current volatility in financial markets, the total non-operating performance improved due to both the decrease in interest expenses on financial debt as well as the reduction of other net non-operating costs. The latter mainly benefit from realized gains from the disposal of the operations in Panama;

- higher impact of taxes. The tax rate increased from 31.5% to 32.6%, mainly due to certain extraordinary events that occurred in Germany;

- result of discontinued operations, equal to € 157 million, resulting from the disposals of Belgium, Generali Leben, Guernsey and Ireland5. The result of € -154 million last year was mainly attributable to the loss on the disposal of the Dutch business.

- The P&L return on investments fell from 2.42% to 2.22%6. The drop was due to lower realised gains and higher impairments as well as a decrease in current profitability compared to the corresponding period.

Balance Sheet and Capital Position

- The shareholders’ equity attributable to the Group amounted to € 23,264 million, down 7.2% compared to € 25,079 million at 31 December 2017. The change was due to the result of the period attributable to the Group, equal to € 1,855 million, more than offset by both the dividend payment totalling € 1,330 million and the reduction of € 2,034 million in the reserve for unrealised gains and losses on available for sale financial assets, deriving from the performance of bonds due to the increase in the spread.

- Third-party Assets Under Management posted an increase of 4.7%, mainly due to performance in China and of Banca Generali.

- The Preliminary Regulatory Solvency Ratio - which represents the regulatory view of the Group’s capital and is based on the use of the internal model, solely for companies that have obtained the relevant approval from IVASS, and on the Standard Formula for other companies - stood at 200% (207% FY17; -7 pps).

The Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the entire Group perimeter, remained at the levels seen in the first six months of the year, or 221% (230% FY17; -9 pps).

For both ratios, the decrease is primarily due to the increase in the spread on Italian government bonds, only partially offset by the solid performance of normalised generation of Group capital.

For significant events that occurred during and after the period ended 30 September 2018, please refer to the press releases available for download at www.generali.com.

The Manager in charge of preparing the company’s financial reports, Cristiano Borean, declares, pursuant to paragraph 2, article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

The glossary and the description of alternative performance measures are available in the 2017 Annual Integrated Report and Consolidated Financial Statements of the Group.

1 Changes in premiums, net cash inflows and PVNBP (present value of new business premiums) are presented in equivalent terms (at constant exchange rates and scope of consolidation). Changes in operating results and own investments exclude entities sold from the comparative period.

2 It was calculated on a rolling basis, as the sum of the last four quarter operating RoE ratios.

3 With reference to the disposals of the Belgian, Guernsey and Generali Leben (German) business, pending the issue of the necessary regulatory authorisations, these assets were classified as disposal groups held for sale, in application of IFRS 5. As a result, these investments were not excluded from consolidation, but total assets, liabilities and earnings after taxes were recognised separately in the specific financial statement items. Profit or loss from discontinued operations also included the realised gain on the disposal of the Irish business. Similarly, the comparative data was restated (2017 data also included Dutch and Irish operations whose sales were completed in February and June 2018, respectively). The disposal of the operations in Panama and Colombia led to realised gains, classified in the non-operating result. They were not deemed relevant based on the Group’s size and were therefore not included in the non-current assets or disposal groups classified as held for sale.

4 ACEER is the regional structure that includes Austria, Central and Eastern European countries, and Russia.

5 This item included the profit of € 49 million on the disposal of the Irish business as well as the contribution to the result from other operations still in the disposal phase.

6 The return was not annualized.