NET INCOME BEATS ESTIMATES

10 November 2022

Generali results maintain growth momentum. Extremely solid capital position.

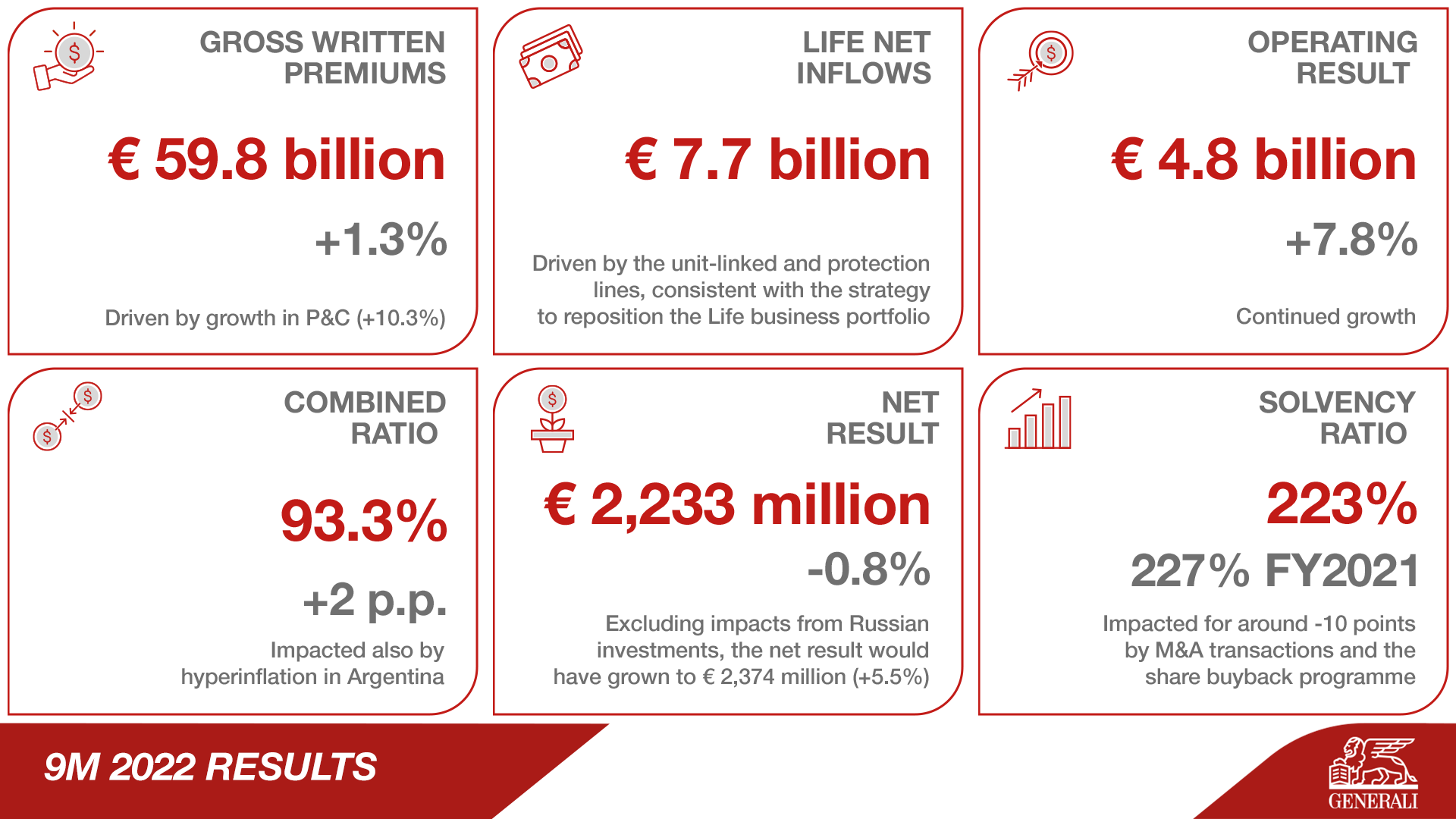

- Gross written premiums increased to € 59.8 billion (+1.3%), driven by growth in P&C (+10.3%), led by the non-motor line. Life premiums contracted (-2.9%). Life net inflows were € 7.7 billion, driven by the unit-linked and protection lines, consistent with the strategy to reposition the Life business portfolio.

- Operating result continued to rise to € 4.8 billion (+7.8%), thanks to the positive performance of the Life and P&C segments. The Combined Ratio was 93.3% (+2 p.p.). New Business Margin was excellent and reached 5.42% (+0.68 p.p.).

- Net result was stable at € 2,233 million (-0.8%). Excluding impacts from Russian investments, the net result would have grown to€ 2,374 million (+5.5%)

- Extremely solid capital position with the Solvency Ratio at 223% (227% FY2021)

Generali Group CFO, Cristiano Borean, said: “The results of the first nine months reflect the solidity of our Group built on the foundations of our strategy to focus on the most profitable business lines and our diversified sources of earnings. This allows us to continue to generate value despite the macroeconomic environment. Generali is successfully achieving sustainable growth and continuously increasing its operating result, reflecting the effective implementation of our 'Lifetime Partner24: Driving Growth' strategic plan.”

1. Changes in premiums, Life net inflows and new business were presented on equivalent terms (at constant exchange rates and consolidation scope). Changes in the operating result, general account investments and Life technical provisions excluded any assets under disposal or disposed of during the same period of comparison. The amounts were rounded at the first decimal point and the amounts may not add up to the rounded total in all cases. The percentage presented can be affected by the rounding.

PRESS RELEASE BELOW.