A quarter of Czechs keep savings in a current account or in cash, according to a survey by Generali Investments CEE

15 April 2021

PRAGUE, 14 April 2021 - A quarter of Czechs still lose part of their savings to inflation. They consider cash or a current account to be the most suitable way to save money, according to a survey by Generali Investments CEE related to the Lion´s Share project. At the same time, however, Czechs are becoming interested in investing, and a fifth of investors are now even more active than before the pandemic. One-tenth of them, for example, invest in cryptocurrencies, but real estate, in particular, remains popular.

Almost a tenth of Czechs still save money in cash. It is even a fifth among people with basic education, according to a survey by Generali Investments CEE related to the Lion’s Share project. Another 14% of respondents consider it best to keep the money saved in a current account.

“In addition, the data shows us that these are not small amounts. More than a fifth of Czechs have over 100,000 crowns in cash or on a current account. Not only are their savings not valued, but they are also exposed to inflation and thus lose value in real terms. For example, last year alone, people managing their savings in this way could lose up to 3.2% of their funds due to inflation and insufficient financial literacy (according to data from the Czech Statistical Office),“ pointed out Petr Mederly, Sales Director of Generali Investments CEE.

“In this sense, Czechs still have a very different approach compared to Western nations. As Eurostat data show, Czech households keep around 45% of their financial capital in cash or in current accounts. For example, in Germany, it is 36% and in the Netherlands even only 15%. In Western Europe, on the other hand, people use investment instruments much more,” he added.

Czechs and investments

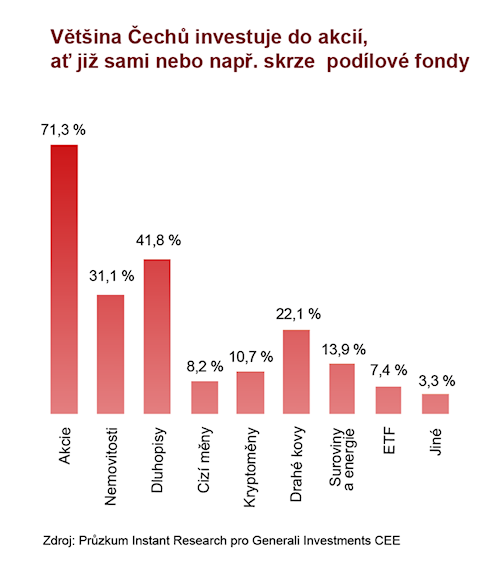

However, Czechs are gradually becoming interested in investments as well. 38% of them currently invest part of their earnings. As shown by the survey, with 15% of people, it accounts for at least a tenth of their income. One-tenth of people considers investing through investment funds to be the most suitable way to save money.

Legend:

Většina Čechů investuje do akcií, ať již sami nebo např. skrze podílové fondy – Most Czechs invest in stocks, either on their own, or, for example, through share funds

Akcie - Stocks

Dluhopisy - Bonds

Kryptoměny - Cryptocurrencies

Suroviny a energie - Raw materials and energy

Jiné - Other

Nemovitosti - Real estate

Cizí měny - Foreign currencies

Drahé kovy - Precious metals

“The survey also pointed to an interesting trend, and that is investing in cryptocurrencies. It was mentioned by 13% of men and 5.4% of women, especially among young people. This confirms both their investment interest and their willingness to try new products, even at the cost of higher risk,” said Petr Mederly.

In general, the comparison has shown that women are more conservative investors. 23.5% of men invest in a high-risk fund, which twice more compared to women. By contrast, women are more than twice as likely to choose a low risk, namely 35%, compared to men.

Effect of the coronavirus on investment

On the other hand, a significant difference in approach is not evident in real estate investments, which have long been very popular in the Czech Republic. 16% of men and less than 15% of women consider direct investment in real estate to be the most suitable way to save money. This is especially true for respondents with a university degree, who, in this sense, with a ratio of 24%, outnumber other groups almost twice.

The Czechs desire to invest was positively affected by the pandemic. After the coronavirus crisis, over 20% of people started investing more than before, while only 12% of Czechs invest less. While 7.4% of people look for less risky products, only 3.3% of respondents now look for more risky products. In more than half of Czechs (56%), the pandemic did not affect investment behaviour.

ABOUT THE SURVEY

The survey was conducted in March 2021 through the Instant Research service. 1,050 respondents from all over the Czech Republic took part in it. Respondents ranged in age from 18 to 65 years.

ABOUT THE LION’S SHARE PROJECT

The Generali Investments CEE long-term project, the Lion's Share, maps investment behaviour in the Czech Republic. It monitors, among other things, preferred investment products, risk propensity, money in accounts and cash. The survey will be repeated periodically and will monitor market trends.

GENERALI INVESTMENTS CEE, INVESTMENT COMPANY, A.S.

It provides services in the field of collective investment and asset management. It has been operating on the market since 1991 (formerly ČP INVEST investiční společnost, a.s.). With assets of more than CZK 353 billion, according to current data, AKAT ČR is the largest asset administrator in the Czech Republic. Generali Investments CEE provides a comprehensive product offer and services to individual investors and institutions. More than 13,500 consultants of the internal and external distribution network, available at a total of 4,500 points of sale, take care of contact with clients and their satisfaction.

THE GENERALI GROUP

Generali Investments CEE is part of the Generali Group, one of the largest global insurance and asset management providers. Established in 1831, it is present in 50 countries in the world, with a total premium income of € 70.7 billion in 2020. With more than 72,000 employees serving 65.9 million customers, the Group has a leading position in Europe and a growing presence in Asia and Latin America. Commitment to sustainability is one of the enablers of Generali’s strategy, inspired by the ambition is to be the life-time partner to its customers, offering innovative and personalized solutions thanks to an unmatched distribution network. In Austria, Central and Eastern Europe and Russia the Group operates through its Austria, CEE & Russia Regional Office (Prague) in 13 countries as one of the top three insurers in the Region.