Inflation and energy prices have complicated the housing situation for more than half of Czechs. They are, however, more optimistic than last year

03 October 2023

Although the housing situation has become more complicated for more than half of Czechs as a result of high inflation and energy prices, they are much more optimistic than last year when considering the affordability of their own housing. The number of those who think that they will not be able to afford their own housing has in fact dropped by 8%. Czechs are also optimistic about real estate prices. More than two-thirds of them believe in the cessation of growth or even a drop in prices. This is according to a survey conducted by Generali Investments CEE. However, people whose mortgage fixation is coming to an end may face problems. If they took out a mortgage for CZK 5 million five years ago, they will now pay almost CZK 8,500 more per month.

A Light at the End of the Tunnel?

While last year the Czechs were most troubled by energy prices in terms of housing (38%), this year it is only 30% thanks to the government’s price-cap regulation and price reduction by suppliers. The opposite trend can be observed in the growth of inflation, which worries a quarter of respondents, while last year it was 21 per cent. Despite this, Czechs are starting to be positive. This observation is based on a survey conducted by Generali Investments CEE in September this year. The data collection was carried out through the Instant Research application of Ipsos.

While last year the Czechs were most troubled by energy prices in terms of housing (38%), this year it is only 30% thanks to the government’s price-cap regulation and price reduction by suppliers. The opposite trend can be observed in the growth of inflation, which worries a quarter of respondents, while last year it was 21 per cent. Despite this, Czechs are starting to be positive. This observation is based on a survey conducted by Generali Investments CEE in September this year. The data collection was carried out through the Instant Research application of Ipsos.

"Last year in August, energy prices reached unprecedented heights and significantly complicated the financial situation of Czech households. We are now observing a stabilisation of the situation compared to last autumn. Price-cap regulation of energy prices, the gradual reduction of prices by suppliers, and a slight reduction in real estate prices or the reduction of mortgage interest rates, though the reduction was rather small, have helped this stabilisation. Therefore, a slight optimism in the vision of acquiring their own home is evident among Czechs. On the other hand, they are still troubled by high inflation. Despite its decline, it remains relatively high and continues to represent the main threat to the wallets of Czechs after two years," observes Marek Bečička, Director of Product & Real Assets of Generali Investments CEE, on the survey results.

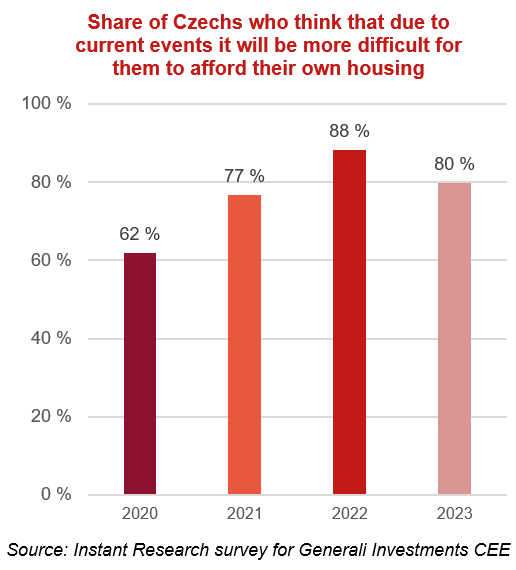

The current favourable development is thus reflected in the hopes of Czechs to purchase their own housing. Compared to last year, the share of Czechs who think that they will not be able to afford their own housing due to inflation, energy prices and interest rates has dropped from 88 to 80 per cent.

33 Metres For 5 Million

Among Czechs who already have a mortgage, the percentage of those who currently have a problem with repaying their mortgage has risen. This is due, among other things, to the expiring five-year fixation of mortgages, which affects tens of thousands of Czechs every year.

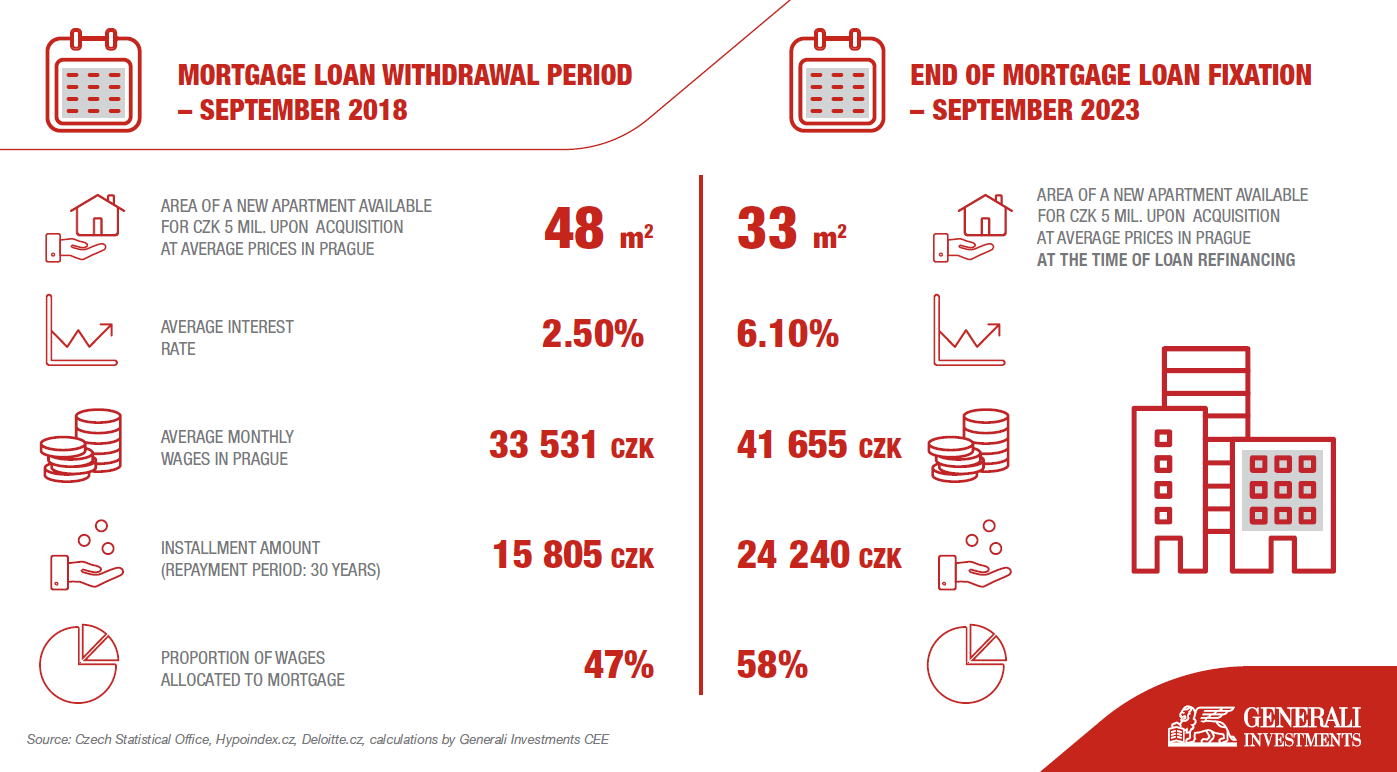

"Just five years ago, it was possible to buy a smaller apartment in Prague with an area of 48 square metres for 5 million crowns. When using a mortgage with a repayment period of 30 years and an LTV of 80% of the real estate price, the repayment amounted to just over 15 thousand crowns per month. This year, for the same money, they would buy an apartment of 33 square metres, which means they would lose 15 metres and pay about 10,000 more," comments Bečička.

While in 2018 an instalment of CZK 15,000 represented approximately 47% of the then average net salary in Prague, an instalment of CZK 24,000 to 25,000 after the end of the fixation currently corresponds to a full 58%.

Czechs Are Willing to Pay Less Per Month for Housing

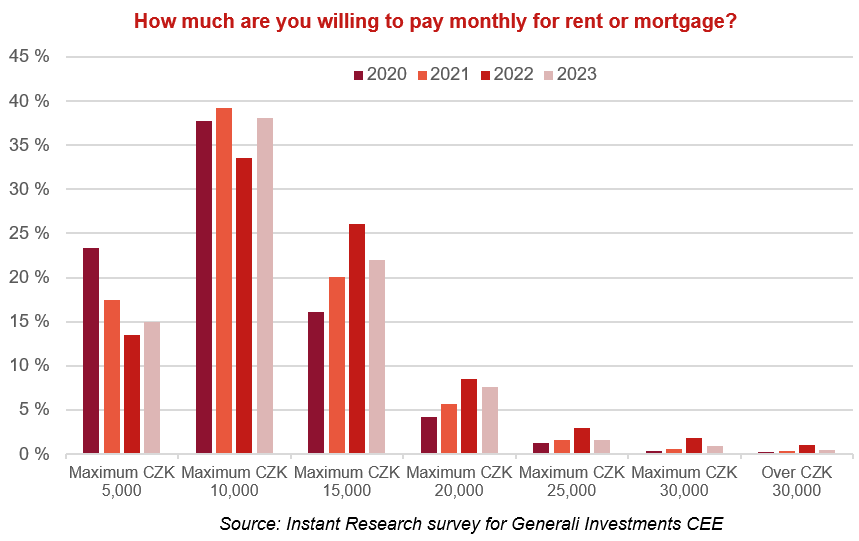

While in autumn 2022 more than a fifth of Czech households were willing to pay up to 15,000 CZK per month for housing, this year it is already only 22%. The percentage of Czechs who spend no more than CZK 10,000 per month on housing has thus increased. From original 34% to 38%. However, Czechs have the same housing requirements from year to year.

"Monthly expenses for rent or mortgage payments remain a challenge for many Czechs, despite the positive trends in the economy. This is also confirmed by our survey. A total of 19% of respondents have reduced the amount they are willing to pay monthly for rent or mortgage by CZK 2,000, another 14% of households by even CZK 5,000. This indicates that households are still looking for ways to save," says Bečička.

Czechs Believe That Real Estate Prices Will Slow Down

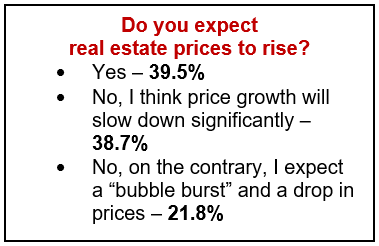

We observe another positive trend in the area of real estate prices. More than two-thirds of Czechs think that real estate prices will no longer increase at the current rate. A total of 39% of respondents believe that real estate prices will slow down, and another 22% of respondents even believe that real estate prices will fall.

We observe another positive trend in the area of real estate prices. More than two-thirds of Czechs think that real estate prices will no longer increase at the current rate. A total of 39% of respondents believe that real estate prices will slow down, and another 22% of respondents even believe that real estate prices will fall.

"Despite the demonstrable optimism in society, which is confirmed by our survey, I think that after a slight correction in real estate prices, stabilisation has taken place and their growth can be expected again in the future. Not so dramatic anymore, but I believe it will continue," concludes Bečička.

Notes For Editors

The Generali Investments CEE’s survey on the situation of Czechs regarding housing was conducted from 14 to 23 September 2023 with a representative sample of 1,050 respondents aged 18–65 from all regions of the Czech Republic. The data collection was carried out through the Instant Research application of Ipsos.